Kalshi is the first CFTC-regulated prediction market in the United States. Trade on real-world events using U.S. dollars from your bank account. No crypto required.

| Founded | 2021 |

| Regulation | CFTC Regulated (DCM) |

| Min Deposit | $1 |

| Fees | Variable, typically under 2% |

| Payment | Bank transfer, debit card, wire |

| Mobile App | Yes (iOS & Android) |

| Best For | U.S. users who want regulation |

Kalshi Pros & Cons

✓ Pros

- CFTC regulated with consumer protections

- Trade using U.S. dollars (no crypto needed)

- Direct bank account integration

- $1 minimum deposit

- Clear resolution processes

- Mobile app available (iOS & Android)

- No blockchain complexity

✗ Cons

- Higher fees than Polymarket (1.2% avg vs 0.01%)

- U.S. only (not available internationally)

- Lower liquidity on some markets

- Fewer markets than Polymarket

- Slower market creation (regulatory approval required)

- $2 withdrawal fee

What Is Kalshi?

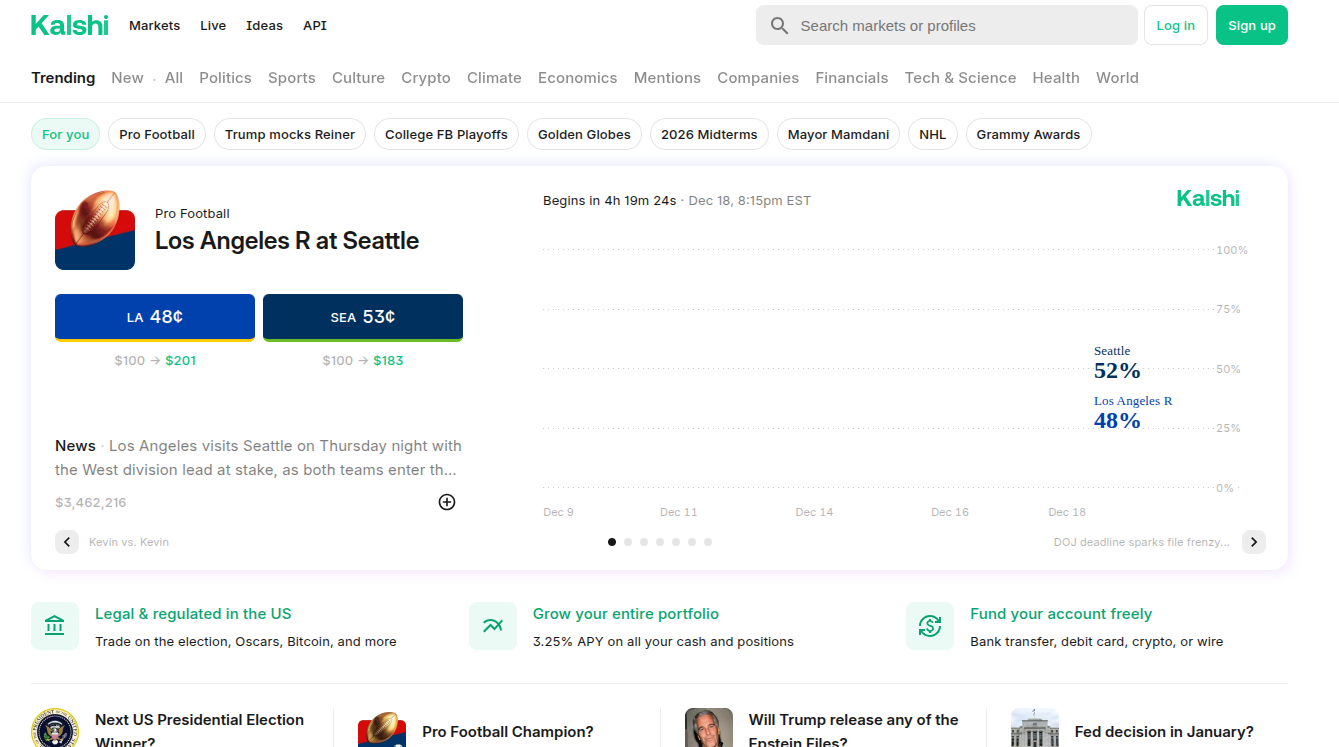

Kalshi is a CFTC-regulated exchange where you trade on real-world event outcomes. It works like a stock market, but instead of companies, you trade on whether specific events will happen.

The platform operates under the same federal rules as commodity exchanges. This means strong consumer protections, transparent rules, and government oversight. You fund your account with U.S. dollars using standard banking methods.

Kalshi processed $5.8 billion in trading volume in November 2025 alone. It offers markets on politics, economics, weather, and current events. All trades settle in cash with clear resolution rules.

How Kalshi Works

Sign up at Kalshi.com with your email. Complete KYC (Know Your Customer) verification with your ID and address. This takes 5-10 minutes and is required by U.S. regulations.

Connect your bank account via ACH (no fee), use a debit card (2% fee), or wire transfer (no fee). Minimum deposit is just $1, but $10-$50 is recommended for meaningful trades.

Explore hundreds of markets across categories. Each shows the current price (probability), trading volume, and resolution date. Markets range from elections to economic data to weather events.

Buy Yes contracts if you think an event will happen, or No contracts if you don’t. Each contract pays $1 if correct, $0 if wrong. You can sell before settlement to lock in profits or cut losses.

When the event resolves, Kalshi’s team checks official sources and settles the market. Winning contracts pay $1 each. Funds appear in your account balance immediately.

Real Example:

You buy 50 Yes contracts at $0.60 each ($30 total). The event happens. You receive $50 (50 contracts × $1). Your profit is $20.

- CFTC regulated

- Trade with USD (no crypto)

- $1 minimum deposit

Kalshi Fees Explained

Deposit Fees:

- ACH bank transfer: $0

- Wire transfer: $0

- Debit card: 2% of deposit amount

Trading Fees:

- Variable, typically under 2% per contract

- Only charged when your order matches immediately

- No fee for limit orders that wait in the order book

Withdrawal Fees:

- Bank withdrawal (ACH): $2 flat fee

- No fee for large withdrawals (over certain thresholds)

Real Cost Example:

On a $100 trade, fees max out around $1.74. Most trades cost less depending on market liquidity and order type.

Comparison:

Polymarket charges 0.01% (100x less) but requires crypto knowledge. PredictIt charges 10% on profits plus 5% withdrawal fee, making it much more expensive than Kalshi.

Hidden Costs:

Watch for bid-ask spread in less liquid markets. Unlike Polymarket, there are no blockchain gas fees since everything is centralized and uses USD.

Who Should Use Kalshi?

Best for:

- U.S. traders who prioritize regulation and legal certainty

- Beginners uncomfortable with cryptocurrency

- Users who want traditional banking integration

- Anyone seeking consumer protections and dispute resolution

Not for:

- International users (U.S. only)

- Crypto enthusiasts who want blockchain transparency

- Traders seeking the absolute lowest fees

- Users who need instant 24/7 market creation

Alternative: If you’re comfortable with crypto and want lower fees with more markets, try Polymarket. It’s now CFTC-approved for U.S. users but requires USDC and wallet management.

Key Features

Full CFTC Regulation

Kalshi is a Designated Contract Market (DCM) under U.S. federal law. This means institutional-grade compliance, regular audits, and government oversight. Your funds are protected by the same rules as traditional commodity exchanges.

Traditional Banking

Connect your bank account via ACH or wire. No need to learn about crypto wallets, USDC, or blockchain. Deposits and withdrawals work like any other financial platform.

Mobile Trading

Native iOS and Android apps provide full trading functionality. The interface is clean and fast, similar to stock trading apps. Place trades, track positions, and manage your account on the go.

Institutional Partnerships

Kalshi integrated with Robinhood in March 2025, giving millions of mainstream investors access to prediction markets. TradingView charts are available for technical analysis.

Transparent Settlement

Every market has detailed rules explaining exactly how outcomes are determined. Kalshi’s team verifies results using official sources (government data, news agencies, etc.) and publishes their methodology.

Safety & Trust

Regulation:

Kalshi is the first and only prediction market platform fully regulated by the CFTC since its 2021 launch. It operates under Designated Contract Market rules, the same framework governing commodity futures.

Security:

Funds are held in segregated accounts at regulated financial institutions. Two-factor authentication protects your account. The platform undergoes regular security audits required by federal regulations.

Track Record:

Since 2021, Kalshi has operated without security breaches or loss of customer funds. The company raised $1 billion at an $11 billion valuation in December 2025, showing strong institutional confidence.

Red Flags:

None currently. Kalshi has maintained a clean regulatory record and transparent operations since launch.

Verdict on Safety:

Kalshi is one of the safest prediction market platforms available. CFTC regulation provides strong consumer protections. Your funds are segregated and the company operates under strict federal oversight.

- CFTC regulated

- Trade with USD (no crypto)

- $1 minimum deposit

Getting Started

Quick Start Checklist:

- Sign up at Kalshi.com (2 minutes)

- Complete KYC with ID and address verification (5 minutes)

- Connect bank account or debit card (3 minutes)

- Deposit at least $10 to start

- Browse markets and find one you understand

- Make your first trade with a small amount

Time Estimate: 15-20 minutes from signup to first trade

Common Mistakes to Avoid:

- Don’t trade on markets you don’t understand (read resolution rules first)

- Don’t ignore the bid-ask spread in low-volume markets

- Don’t forget about the $2 withdrawal fee when planning trades

- Don’t assume all markets are equally liquid (check volume)

Frequently Asked Questions

Yes. Kalshi is fully regulated by the CFTC as a Designated Contract Market. It operates under the same federal framework as commodity exchanges like CME Group.

This regulation provides consumer protections including fund segregation, transparent rules, dispute resolution processes, and regular government audits. Kalshi is the only prediction market platform to launch with full regulatory approval from day one.

Kalshi offers regulation and simplicity. Polymarket offers lower fees and more markets. The choice depends on your priorities.

Choose Kalshi if you want CFTC regulation, USD deposits, and a traditional experience. Choose Polymarket if you’re comfortable with crypto and want fees 100x lower.

Kalshi’s fees average 1.2% versus Polymarket’s 0.01%. But Kalshi works with your bank account while Polymarket requires crypto knowledge. See our full comparison for details.

No. Kalshi is only available to U.S. residents and citizens. You must verify your U.S. address during KYC and maintain a U.S. bank account.

International users should explore Polymarket (now globally available) or other platforms serving their regions.

You can buy as little as one contract (usually $0.01 to $0.99 depending on market price). There’s no minimum trade size, though very small trades may not make sense due to fees.

With a $1 deposit, you could theoretically trade, but $10-$50 provides more flexibility to learn and experiment.

ACH bank withdrawals take 3-5 business days. Wire transfers can arrive within 1 business day but may have additional bank fees.

All withdrawals incur a $2 Kalshi fee. There’s no minimum withdrawal amount. You can withdraw your entire balance at any time.

Rarely, but it can happen. Each market has detailed resolution rules. If an outcome is ambiguous or disputed, Kalshi’s team reviews the situation based on pre-defined criteria.

The platform publishes resolution sources and methodology. In rare disputes, CFTC regulations provide a formal complaint process. This transparency and oversight is a key advantage over unregulated platforms.

Final Verdict

Kalshi is the best prediction market platform for U.S. users who prioritize regulation, simplicity, and traditional banking. It’s the safest, most transparent option available.

Bottom line: If you want CFTC oversight, don’t want to deal with crypto, and value consumer protections, Kalshi is your top choice. If you’re comfortable with crypto and want the absolute lowest fees, consider Polymarket instead.

The platform’s fees are higher than competitors, and it’s U.S.-only. But for American traders seeking a regulated, easy-to-use experience, Kalshi delivers. The platform feels like a stock trading app, not a crypto experiment.

Our recommendation: Start with a $20 deposit. Try a simple market (yes/no question with clear resolution rules). See if the interface and fee structure work for you before scaling up.

- CFTC regulated

- Trade with USD (no crypto)

- $1 minimum deposit